- Maritime Piracy

- TalkFraud

- Membership

- Investigation

- Products & Services

The IMB aware of the escalating level of this criminal activity, wanted to provide a free service to the seafarer and established the 24 hour IMB Piracy Reporting Centre (PRC) in Kuala Lumpur, Malaysia.

A newsletter about fraud and global asset recovery from the office of International Chamber of Commerce's FraudNet. To read about key asset recovery cases and global compliance with anti-fraud and money-laundering laws, please click in the link above for the Newsletter PDF.

CCS offers a flexible membership arrangement based on the selection of predetermined membership packages. A prospective member can elect to join one or more Bureaux according to their requirements.

Losses due to official misconduct account for a great many maritime trade incidents. Each incident can be complex and wide-ranging in nature. It is therefore unlikely that any one company will have the knowledge and resources to be able to investigate it thoroughly.

Counterfeiting and piracy are a drain on our businesses and on the global economy. It has resulted in the widespread loss of lawful employment and a massive reduction of tax revenues.

Contact

Contact

© Commercial Crime Services, a division of the ICC Company limited by guarantee registered in England No 05716642 Registered office Cinnabar Wharf, 26 Wapping High Street LONDON E1W 1NG Tel: +44 (0)20 7423 6960 E-mail us your comments and remarks

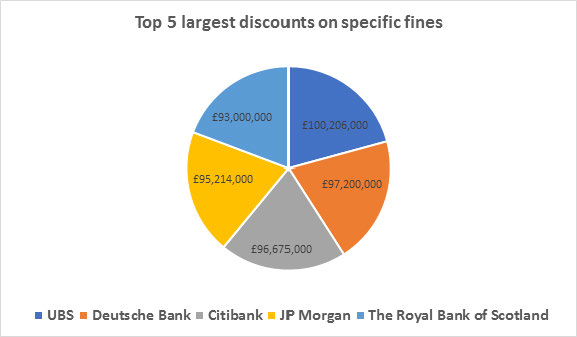

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed.

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank New City Agenda has revealed. Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank

Banks and financial firms have received discounts of £1.2 billion on fines imposed by the UK Financial Conduct Authority (FCA) in the last four years, recently released data by the think-tank